Analysis of the Top 10 Drip Irrigation Manufacturers in 2025

Drip irrigation, a highly efficient micro-irrigation method, delivers water and nutrients directly to plant roots, minimizing waste and optimizing crop yields. As global water scarcity intensifies and the demand for sustainable agriculture grows, the drip irrigation market is projected to reach $8.6 billion by 2029, growing at a compound annual growth rate (CAGR) of 9.0% from $5.6 billion in 2024. This article analyzes the top 10 drip irrigation manufacturers, based on market share, innovation, and strategic initiatives, highlighting their contributions to the industry.

Market Overview

The drip irrigation market is moderately consolidated, dominated by a mix of multinational corporations and specialized regional players. Leading companies leverage extensive distribution networks, robust research and development (R&D), and innovative technologies to maintain their positions. The market is driven by the need for water conservation, precision agriculture, and government initiatives promoting sustainable farming practices. Key trends include the integration of smart irrigation systems, AI-driven solutions, and partnerships to expand market reach. Below is an analysis of the top 10 drip irrigation manufacturers based on their market influence, product portfolios, and recent developments.

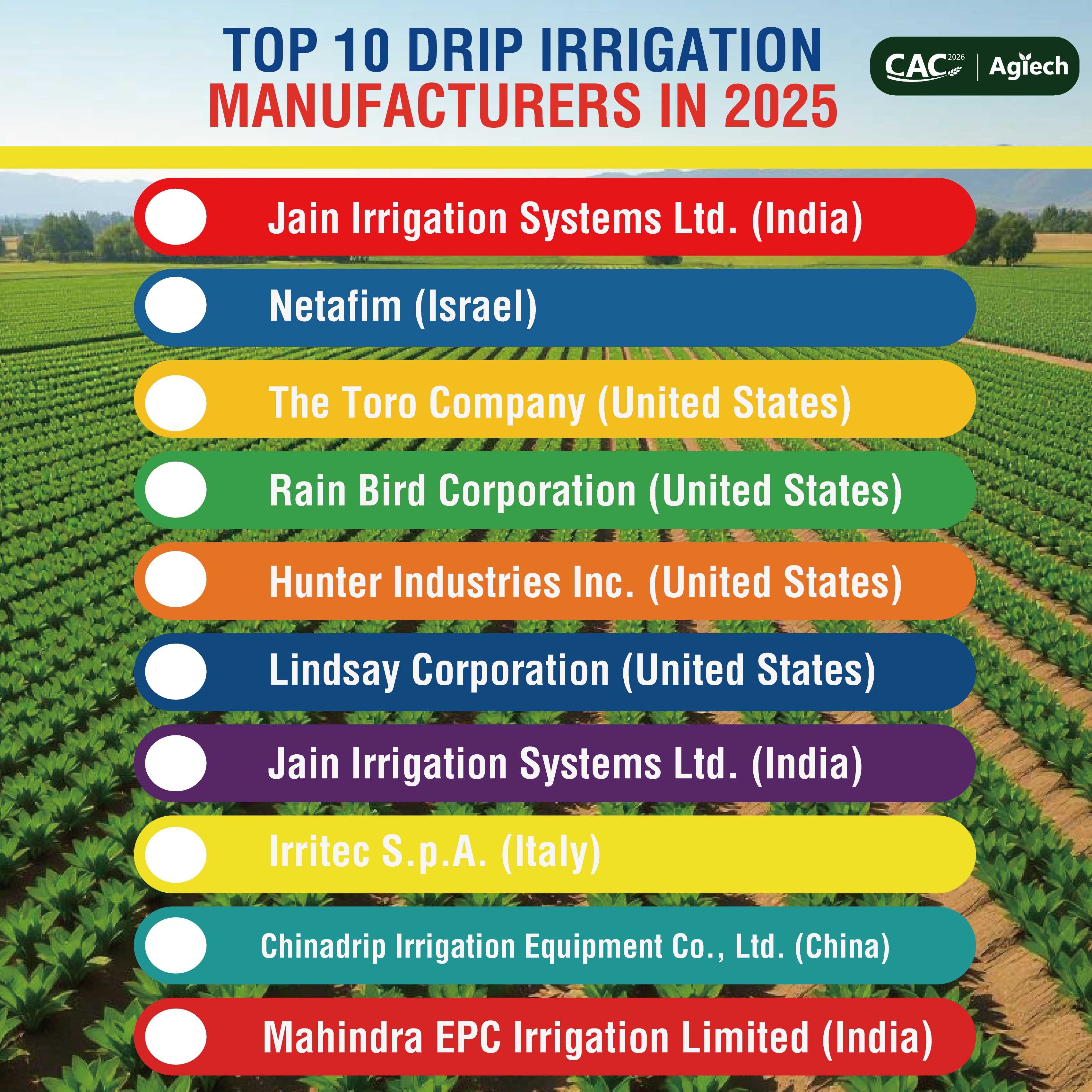

Top 10 Drip Irrigation Manufacturers

1. Jain Irrigation Systems Ltd. (India)

- Overview: Headquartered in Jalgaon, Maharashtra, Jain Irrigation is a global leader with a turnover exceeding $1.2 billion and 33 manufacturing plants across four continents. It serves over 10 million farmers in 126+ countries, offering a comprehensive range of drip lines, emitters, and automation systems.

- Strengths: Known for its sustainable practices and extensive product portfolio, including drip kits and integrated irrigation automation systems. Its 2,300-acre Hi-Tech Agri Institute supports R&D and farmer training.

- Recent Developments: In 2023, Jain Irrigation strengthened its global presence through strategic partnerships and expanded its micro-irrigation offerings for smallholder farmers.

- Market Edge: Strong focus on affordability and sustainability, particularly in water-scarce regions like India and Africa.

2. Netafim (Israel)

- Overview: A pioneer in drip irrigation since 1965, Netafim, an Orbia business, operates in 110 countries with 33 subsidiaries and 19 manufacturing plants. It is a leader in digital farming, offering real-time monitoring and automated control systems.

- Strengths: Netafim’s product range includes drippers, drip lines, sprinklers, and its Bioline® system for wastewater recycling. Its Toofan drip line, launched in 2023, targets 25,000 hectares in India by 2025, featuring anti-clogging technology and affordability.

- Recent Developments: In 2024, Netafim advanced its digital farming solutions with cloud-based platforms for precision irrigation.

- Market Edge: Global reach and leadership in smart irrigation technologies make Netafim a top choice for large-scale and smallholder farmers.

3. The Toro Company (United States)

- Overview: Founded in 1914 and headquartered in Bloomington, Minnesota, The Toro Company is a major player in irrigation equipment, serving agriculture, landscaping, and turf management.

- Strengths: Offers a wide range of drip irrigation products, including drip tapes and emitters, with a focus on durability and efficiency. Its partnership with Sentosa Golf Club in 2022 highlights its commitment to sustainable landscaping solutions.

- Recent Developments: In 2024, Toro expanded its smart irrigation portfolio with IoT-based controllers and sensors.

- Market Edge: Strong brand recognition and diverse applications across agricultural and non-agricultural sectors.

4. Rain Bird Corporation (United States)

- Overview: Based in Azusa, California, Rain Bird is a global leader in irrigation products, known for its controllers, sensors, and sprinkler nozzles.

- Strengths: Its Flow-Indicating Basket Filter, launched in 2021, simplifies irrigation system maintenance. Rain Bird excels in both agricultural and landscape irrigation.

- Recent Developments: In 2024, Rain Bird introduced advanced software for real-time irrigation management, enhancing water efficiency.

- Market Edge: Robust R&D and a focus on user-friendly, sustainable solutions.

5. Hunter Industries Inc. (United States)

- Overview: Headquartered in San Marcos, California, Hunter Industries is renowned for its advanced irrigation systems, including controllers, sensors, and water flow meters.

- Strengths: Emphasizes environmental sustainability and precision irrigation, catering to agriculture, landscaping, and golf courses.

- Recent Developments: In 2024, Hunter launched new smart irrigation controllers with cloud-based integration for remote monitoring.

- Market Edge: Strong distribution network and commitment to eco-friendly technologies.

6. Rivulis (Israel)

- Overview: Rivulis, with 22 manufacturing facilities and 3,000 employees, is a leading provider of micro-irrigation solutions, including drip lines and micro-sprinklers.

- Strengths: Its partnership with Dragon-Line in 2023 introduced a mobile drip irrigation system for the U.S., Mexico, and Canada. Rivulis AI, launched in 2024, provides tailored irrigation insights.

- Recent Developments: The D4000 PC drip irrigation system, unveiled in 2024, targets previously unusable land for irrigation.

- Market Edge: Focus on innovation and partnerships enhances its competitive position.

7. Lindsay Corporation (United States)

- Overview: Founded in 1955 and based in Omaha, Nebraska, Lindsay Corporation specializes in pivot and drip irrigation systems, operating in over 90 countries.

- Strengths: Known for its advanced water management solutions, Lindsay’s systems optimize agricultural productivity and water conservation.

- Recent Developments: In 2024, Lindsay expanded its smart irrigation offerings with IoT-based monitoring systems.

- Market Edge: Strong presence in large-scale agriculture and infrastructure projects.

8. Irritec S.p.A. (Italy)

- Overview: Founded in 1974 and headquartered in Italy, Irritec specializes in drip and micro-irrigation systems for agriculture, landscaping, and greenhouses.

- Strengths: Focuses on sustainability and water efficiency, offering customizable solutions for diverse applications.

- Recent Developments: In 2024, Irritec enhanced its product line with automated drip systems for small-scale farmers.

- Market Edge: Strong European presence and commitment to eco-friendly irrigation.

9. Chinadrip Irrigation Equipment Co., Ltd. (China)

- Overview: Based in Xiamen, China, Chinadrip is a key player in the Asian market, offering affordable drip irrigation products like drippers, drip tapes, and fittings.

- Strengths: Competitive pricing and a wide product range make it popular among smallholder farmers in Asia.

- Recent Developments: In 2023, Chinadrip expanded its export markets, focusing on Southeast Asia and Africa.

- Market Edge: Cost-effectiveness and scalability for emerging markets.

10. Mahindra EPC Irrigation Limited (India)

- Overview: An Indian company under the Mahindra Group, EPC Irrigation manufactures drip and sprinkler systems, focusing on the domestic market.

- Strengths: Offers tailored solutions for Indian farmers, supported by government subsidies under the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY).

- Recent Developments: In 2024, EPC expanded its automation offerings for precision irrigation.

- Market Edge: Strong local presence and alignment with government initiatives.

Market Trends and Strategies

1. Smart Irrigation and Automation

Leading manufacturers are integrating IoT, AI, and cloud-based platforms into drip irrigation systems. For example, Netafim’s digital farming solutions and Rivulis AI enable real-time monitoring and automated control, reducing water waste by up to 50%.

2. Sustainability Focus

Companies like Jain Irrigation and Irritec emphasize sustainable practices, such as wastewater recycling and low-pressure systems, aligning with global water conservation goals. Netafim’s ReGen Recycling program, for instance, recycles used driplines into new products.

3. Geographic Expansion

Manufacturers are targeting emerging markets like Asia-Pacific and Africa, where water scarcity and population growth drive demand. Jain Irrigation and Chinadrip are expanding in these regions through affordable, scalable solutions.

4. Partnerships and Acquisitions

Strategic collaborations, such as Rivulis’ partnership with Dragon-Line and Toro’s agreement with Sentosa Golf Club, enhance market reach and innovation.

Challenges

- High Initial Costs: Advanced drip systems can cost $25,000-$50,000 per acre, limiting adoption among smallholder farmers.

- Regulatory Variations: Differing regulations across countries complicate global expansion for companies like Netafim and Rivulis.

- Maintenance and Clogging: Despite advancements in anti-clogging technology, emitter blockages remain a challenge, requiring regular maintenance.

Future Outlook

The drip irrigation market is expected to grow at a CAGR of 11% from 2025 to 2034, driven by water conservation needs and precision agriculture adoption. Leading manufacturers will likely focus on:

- AI and IoT Integration: Enhancing automation and data-driven irrigation.

- Affordable Solutions: Developing cost-effective systems for smallholder farmers.

- Sustainability: Expanding recycling programs and low-energy systems.

Conclusion

The top 10 drip irrigation manufacturers—Jain Irrigation, Netafim, The Toro Company, Rain Bird, Hunter Industries, Rivulis, Lindsay Corporation, Irritec, Chinadrip, and Mahindra EPC—are driving innovation and sustainability in agriculture. Their focus on smart technologies, global expansion, and water-efficient solutions positions them to meet the growing demand for drip irrigation. As the industry evolves, these companies will play a critical role in addressing global challenges like water scarcity and food security, ensuring sustainable farming practices for the future.