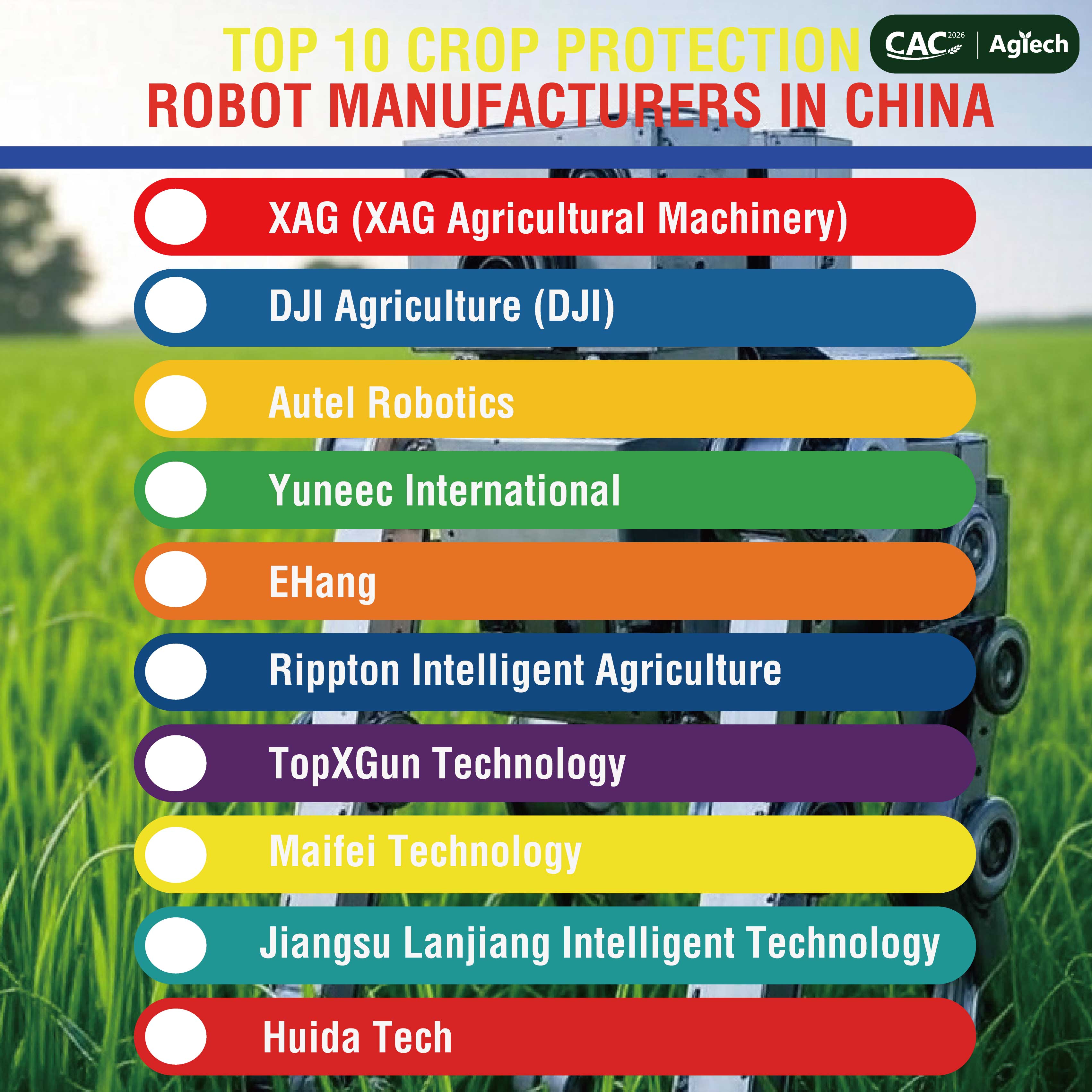

Top 10 Crop Protection Robot Manufacturers in China

Crop protection robots primarily include autonomous drones, sprayers, and ground-based machines designed for tasks like pesticide application, weed control, pest monitoring, and disease prevention in agriculture. China leads globally in this sector, driven by companies specializing in AI-integrated robotics for precision farming. Based on industry analyses, funding, market presence, and product innovation as of 2025, here is a list of the top 10 manufacturers. This ranking considers factors such as company scale, technological advancements, and adoption in crop protection applications (e.g., spraying drones and weeding robots). Note that rankings can vary by specific metrics like revenue or exports, but these are the most prominent.

Rank | Company Name | Headquarters/Key Location | Key Products/Focus | Notable Highlights |

1 | XAG (XAG Agricultural Machinery) | Guangzhou, Guangdong | Agricultural drones (e.g., P100 Pro for spraying), AI-based crop monitoring and protection systems | Leading global exporter of ag-drones; raised over $400M in funding; specializes in variable-rate spraying to reduce pesticide use by up to 30%. |

2 | DJI Agriculture (DJI) | Shenzhen, Guangdong | Crop protection drones (e.g., Agras T40 for precision spraying and pest control) | World's largest drone maker; offers multispectral imaging for disease detection; serves millions of hectares annually in China and abroad. |

3 | Autel Robotics | Shenzhen, Guangdong | Agricultural UAVs for spraying and scouting (e.g., EVO II series adapted for crop protection) | Known for high-resolution cameras in drones for weed and pest identification; expanding into AI-driven autonomous fleets. |

4 | Yuneec International | Kunshan, Jiangsu | Crop monitoring and spraying drones (e.g., H520 series for agriculture) | Focuses on durable, user-friendly robots for large-scale farms; integrates thermal imaging for early pest detection. |

5 | EHang | Guangzhou, Guangdong | Autonomous aerial vehicles for crop spraying and protection | Pioneers in eVTOL tech adapted for ag; emphasizes eco-friendly, low-emission spraying solutions. |

6 | Rippton Intelligent Agriculture | Guangzhou, Guangdong | Plant protection drones and ground robots for weeding/spraying | Develops hyperspectral tech for targeted pesticide application; funded startup with strong domestic market share. |

7 | TopXGun Technology | Shenzhen, Guangdong | Heavy-duty spraying drones (e.g., TX series for orchards and fields) | Specializes in high-payload robots for dense crop areas; used in over 50 countries for pest control. |

8 | Maifei Technology | Beijing | Robotic sprayers and AI platforms for crop health monitoring | Offers integrated systems combining drones and ground bots; focuses on data analytics for predictive protection. |

9 | Jiangsu Lanjiang Intelligent Technology | Nanjing, Jiangsu | Orchard protection robots (e.g., automated spraying and weeding machines) | Developer of smart machinery for fruit crops; emphasizes automation to address labor shortages in Chinese orchards. |

10 | Huida Tech (or similar emerging: e.g., Beijing Kuangshi) | Beijing/Shenzhen | AI vision-based weeding and spraying robots | Rising player in computer vision for selective herbicide application; backed by investments in precision ag tech. |

These companies dominate due to China's supportive policies for smart agriculture and heavy R&D investment (e.g., over 38 startups in ag-robotics as of mid-2025). Many focus on drones, as they enable efficient, large-scale protection, but ground robots are growing for specialty crops. For the latest updates, market shares can shift with new funding or exports.