Agricultural Technology Development in the USA

Agricultural Technology Development in the USA

Executive Summary

The United States has long been a global leader in agricultural innovation, transforming from labor-intensive subsistence farming in the 18th century to a high-tech industry driven by precision agriculture, AI, and biotechnology in 2025. This report examines the historical evolution, current advancements, key stakeholders, government support, and future trends in U.S. agricultural technology (agritech). As of September 2025, agritech adoption is accelerating, with over 60% of farms projected to use precision tools, enhancing productivity while addressing sustainability challenges like climate change and resource scarcity. Driven by federal initiatives and private sector investments, the sector is poised for continued growth, aiming to increase food production by 40% while halving environmental impacts by 2050.

Introduction

Agriculture remains a cornerstone of the U.S. economy, contributing over $1.2 trillion annually and employing millions, though only about 2% of the population now works in farming. Technological advancements have been pivotal in this shift, enabling fewer farmers to feed more people— from one farmer supplying 10.7 people in 1940 to nearly 76 by 1970. Today, agritech encompasses a wide array of tools, from GPS-guided tractors to AI-driven crop monitoring, addressing global pressures such as population growth (projected to reach 10 billion by 2050) and climate variability. This report draws on recent data and analyses to provide a comprehensive overview of agritech development in the USA.

Historical Development

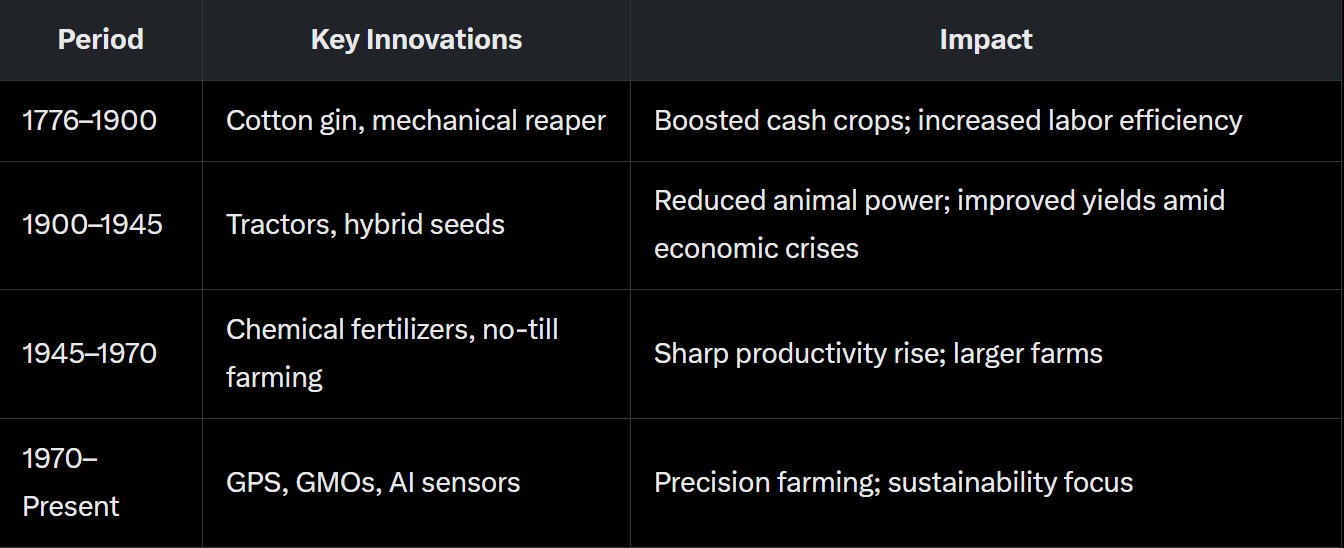

The history of U.S. agricultural technology reflects a progression from manual tools to mechanized and digital systems, marked by several revolutions.

Early Foundations (1776–1900)

Post-independence, agriculture was subsistence-based, with innovations like the cotton gin (1793) by Eli Whitney revolutionizing Southern farming by boosting cotton production. The mid-19th century saw the rise of mechanical reapers, invented by Cyrus McCormick in the 1830s, which automated grain harvesting and increased productivity. By 1870, nearly half the workforce was in agriculture, but westward expansion and the Homestead Act (1862) spurred land use and basic mechanization.

The First Agricultural Revolution (1900–1945)

The introduction of gasoline tractors in the 1890s, followed by widespread adoption in the 1920s, reduced reliance on horses and mules. By 1930, hybrid corn seeds emerged, improving yields. The Dust Bowl era (1930s) highlighted the need for soil conservation, leading to the Soil Conservation Service (1935) and early irrigation tech. World War II accelerated mechanization, with one farmer supplying 10.7 people by 1940.

The Second Agricultural Revolution (1945–1970)

This period featured a shift to tractors (surpassing horses by 1954) and chemical inputs like fertilizers. By 1968, 96% of cotton was mechanically harvested. Innovations included no-tillage farming (popularized in the 1970s) and the first four-row cotton picker (1980). Productivity per acre rose sharply, with average farm size expanding to 390 acres by 1970.

Modern Era (1970–Present)

The 1980s–1990s introduced GPS and biotechnology, such as genetically modified crops from Monsanto (now Bayer). The 2000s brought precision agriculture, with variable-rate applications reducing inputs. By 2023, only 27% of farms used precision practices, but adoption is surging. California's early adoption of tractors, harvesters, and pumps made it a mechanization leader by 1958.

Current State of Agritech in the USA

As of 2025, U.S. agritech is characterized by sophisticated tools that integrate data analytics, automation, and biotechnology. Modern farms use robots, IoT sensors, drones, and GPS for precision agriculture, allowing targeted application of water, fertilizers, and pesticides. This reduces waste, enhances profitability, and minimizes environmental harm, such as fertilizer runoff.

Key current technologies include:

- Precision Agriculture: Adopted by 27% of farms in 2023, projected to reach 60–75% by 2025 on large operations. Tools like variable-rate applicators and yield monitors optimize inputs.

- AI and Data Platforms: AI-driven platforms (e.g., Farmonaut) provide real-time field data via satellite and apps, improving yields and sustainability.

- Robotics and Automation: Autonomous tractors (e.g., John Deere's 2025 models) and robotic harvesters address labor shortages.

- Biotechnology: Gene editing for resilient crops and biological inputs for pest control.

- Urban and Vertical Farming: Hydroponics and controlled environment agriculture (CEA) in cities, with over 60% of new robots deployed in sustainable urban systems.

The USDA reports that these technologies make farming safer, more efficient, and environmentally friendly, with one farmer now supplying over 150 people globally. However, challenges persist: high upfront costs, complexity, and uneven adoption (lower on small farms).

Key Players in the Agritech Industry

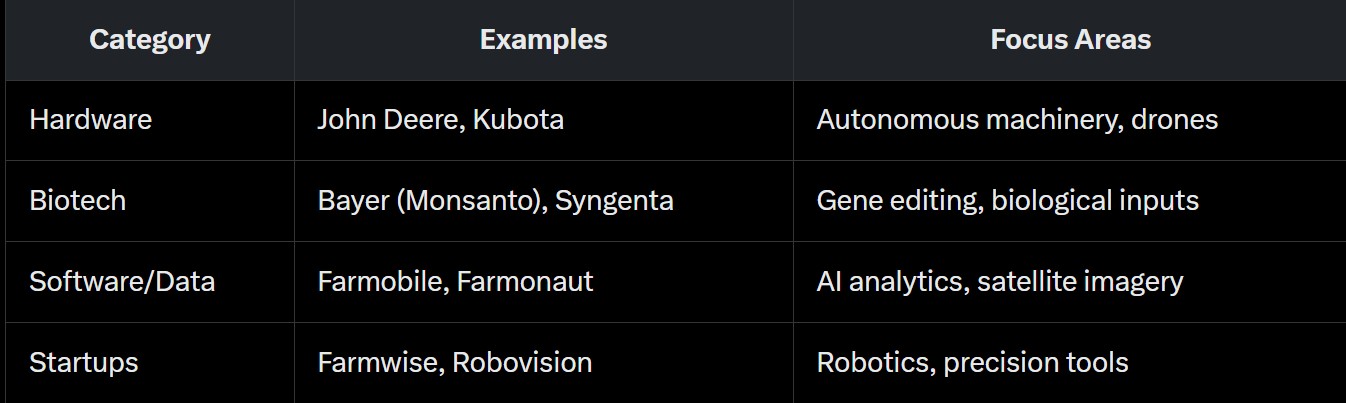

The U.S. agritech landscape features established giants and innovative startups. Major companies drive hardware and biotech, while startups focus on software and niche solutions.

Major Corporations

- John Deere: Leader in autonomous tractors and precision tech; unveiled driverless systems at CES 2025 for tillage and spraying.

- Monsanto (Bayer): Pioneers in GMOs and biotech; invests in crop protection and gene editing.

- Cargill: Integrates AI for supply chain and farm management.

- Syngenta: Focuses on crop protection and sustainable solutions, with heavy R&D in agritech.

Startups and Innovators

- Farmobile: Provides data platforms for farm analytics.

- Benson Hill: Uses AI for crop improvement.

- Farmwise: Develops AI-powered weeding robots.

- Indigo Ag: Specializes in microbiome and carbon farming.

- Robovision: AI vision systems for robotics in planting and harvesting.

- Farmonaut: Satellite-based monitoring with API integration.

Venture funding is robust, with over 7,000 agritech startups. Investments target AI, robotics, and sustainability, with companies like Agreena raising $22.5 million for carbon credit platforms.

Government Initiatives and Support

The U.S. government, primarily through the USDA and NSF, plays a crucial role in funding and promoting agritech. The Agriculture Innovation Agenda (AIA) aligns public-private research to boost production by 40% and cut environmental footprints by 50% by 2050.

Key initiatives:

- NIFA Programs: Supports R&D in sensors, robotics, and AI; invested nearly $200 million in precision ag from 2017–2021. Focuses on advanced technologies for food security and energy independence.

- SBIR/STTR Grants: Over $12.5 million in 2023 for small business innovation, including partnerships with research institutions.

- Urban Agriculture and Innovative Production (UAIP) Grants: $14.4 million in 2025 for hydroponics, vertical farming, and job training in distressed communities.

- Precision Agriculture Support: Financial assistance via conservation programs; GAO recommends policies to address adoption barriers like costs.

- NSF Engines: North Dakota AgTech Engine partners with AgLaunch for regenerative tech and equity for growers.

- Science and Research Strategy (2023–2026): Emphasizes innovation for prosperity and sustainability.

These efforts include education, loans, and technical assistance, with examples like hydroponic projects in Wisconsin schools.

Future Trends

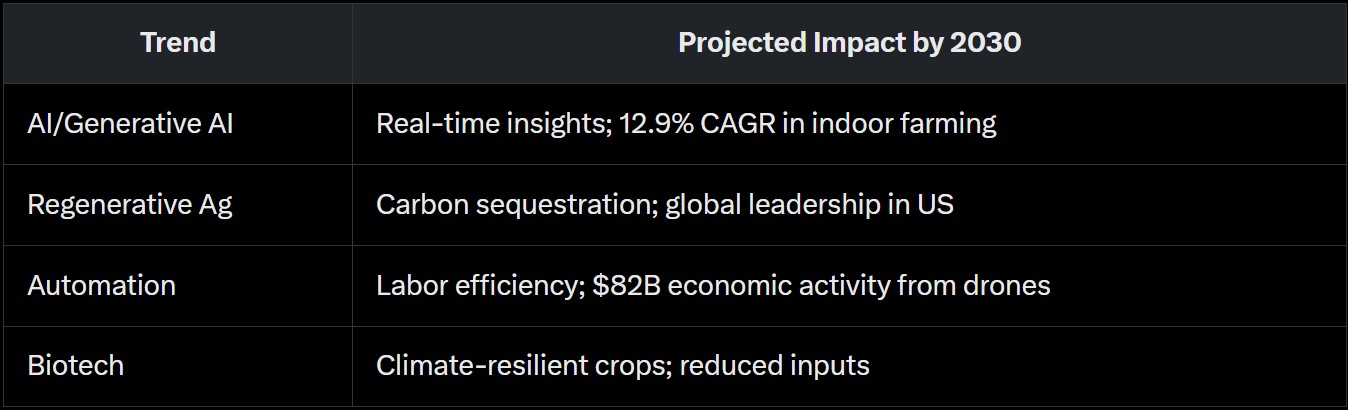

Looking ahead, U.S. agritech will emphasize sustainability, automation, and data integration to combat climate change and food insecurity. Key trends for 2025 and beyond:

- AI and Generative AI Expansion: AI for predictive analytics, digital twins (virtual field models), and decision support; expected to optimize biologicals and trials. Adoption in North America: 61% for digital tools.

- Regenerative and Sustainable Practices: Carbon farming, microbiome analysis, and MRV tech; indoor farming market to hit $42 billion in 2025.

- Automation and Robotics: Autonomous grain carts, swarming tech, and AI-automated CEA; addresses labor shortages with 24/7 operations.

- Biotech and Precision Fermentation: Resilient crops, alternative proteins; scaling infrastructure for cost reduction.

- Renewable Energy Integration: Solar-powered farms and byproduct energy for revenue diversification.

- Data Interoperability and Blockchain: For supply chain traceability and resource optimization.

By 2030, digital agriculture market growth will focus on cloud solutions and regenerative methods. Challenges include scaling for small farms and equitable access, but trends point to a resilient, tech-driven sector.

Conclusion

U.S. agricultural technology has evolved from rudimentary tools to a sophisticated ecosystem integrating AI, robotics, and biotech, driven by historical mechanization and current innovations. Key players like John Deere and startups like Farmwise, supported by USDA initiatives, are positioning the sector for sustainable growth. As trends like AI and regenerative practices gain traction, agritech will be essential for feeding a growing population while mitigating environmental risks. Continued public-private collaboration will ensure the USA remains a global agritech leader, fostering economic vitality and food security.