Only 4 companies will have sales of over 1 billion in the first half of 2025!

In the past two years, China's agricultural machinery market has been undergoing a deep reshuffle. Under the multiple pressures of low grain prices, overcapacity, and shrinking demand, the industry as a whole has fallen into the dilemma of "not prosperous in the peak season". According to data from the National Bureau of Statistics, from January to May 2025, the output of wheeled tractors decreased by 8.04% year-on-year, the sales of harvesting machinery remained the same year-on-year, but the sub-categories were severely differentiated, the corn harvester market shrank, and the production and sales of wheeled harvesters both fell. Even the leading companies are not at ease.

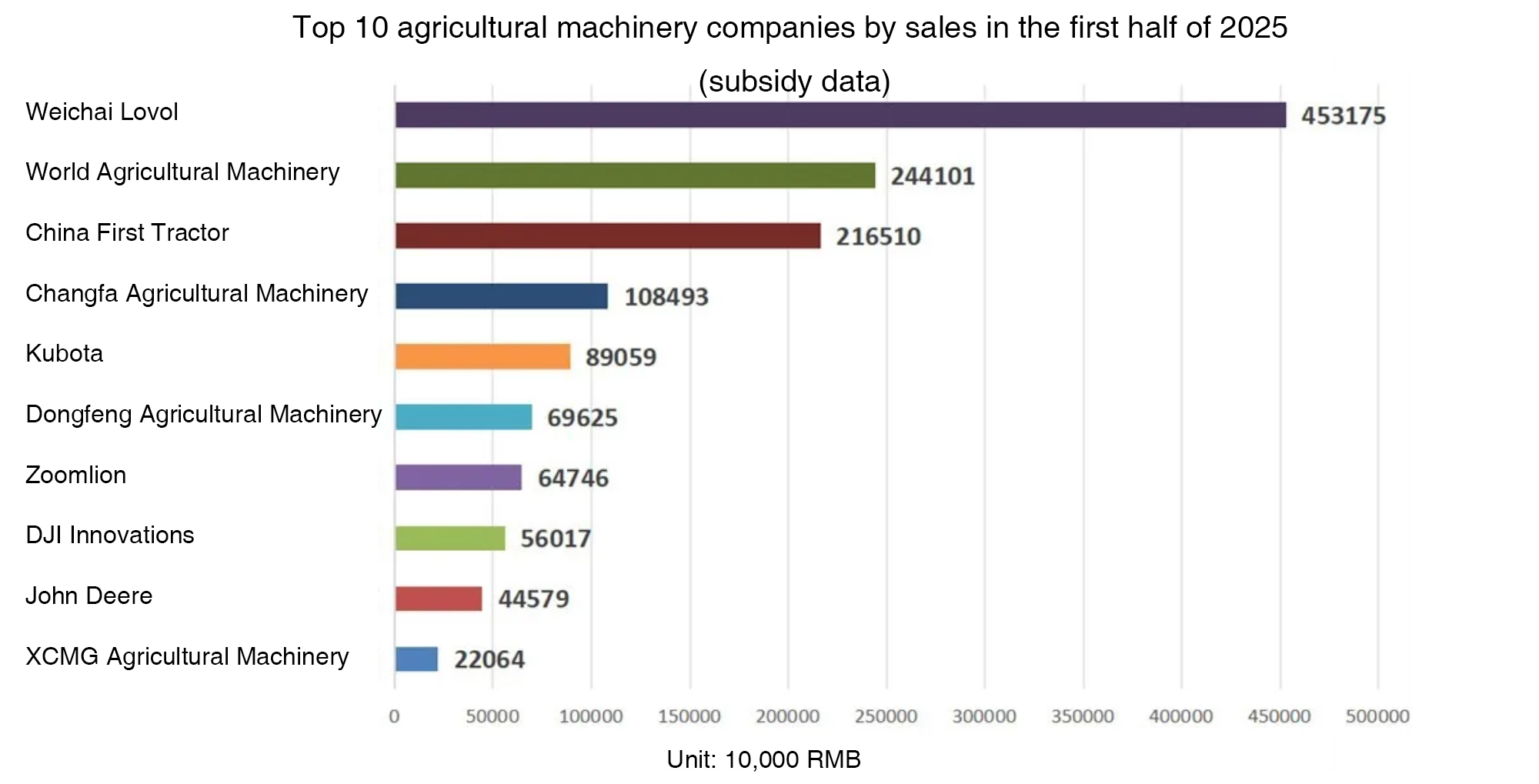

However, there is also vitality in the crisis. In the cold winter of the industry, some small and medium-sized enterprises have withdrawn from the market due to broken capital chains or backward technology, but more companies have chosen to break through against the trend: Weichai Lovol has achieved sales of 4.53 billion yuan (subsidy data) in the first half of the year with its full product category layout and intelligent upgrades, ranking first in the industry; DJI Innovations has defeated many old agricultural machinery companies with sales of 560 million yuan using plant protection drones as its entry point; China First Tractor has accelerated its pace of "going out", with overseas business covering more than 90 countries, and tractor exports increasing by 8.23% year-on-year. At the same time, intelligence, new energy, and high-end have become the key to the industry's breakthrough - Beidou navigation agricultural machinery coverage exceeds 67%, continuously variable speed tractors fill the domestic gap, and hybrid models are accelerating their landing.

Behind this industrial transformation is the pain of transformation from traditional agricultural machinery to "smart agricultural service providers", and it is also the only way for Chinese companies to go from "manufacturing" to "smart manufacturing" under the global competitive landscape. When some companies fall, others are using innovation as a spear and resilience as a shield to ignite new hope in the cold winter of the agricultural machinery industry.

According to the public data statistics of national agricultural machinery purchase subsidies, the sales volume of various types of agricultural machinery products in the first half of 2025 was 1.269 million units, with sales of nearly 23.29 billion yuan, a year-on-year decline of nearly half compared with 2024. Among them, there are only 4 companies with sales of more than 1 billion yuan, a year-on-year decrease of two; there are 16 companies with sales of more than 100 million yuan, a year-on-year decrease of nearly 30. The top five companies in terms of sales are Weichai Lovol, 4.53 billion yuan; World Agricultural Machinery, 2.44 billion yuan; China First Tractor, 2.17 billion yuan; Changfa Agricultural Equipment, 1.08 billion yuan; Kubota, 890 million yuan.

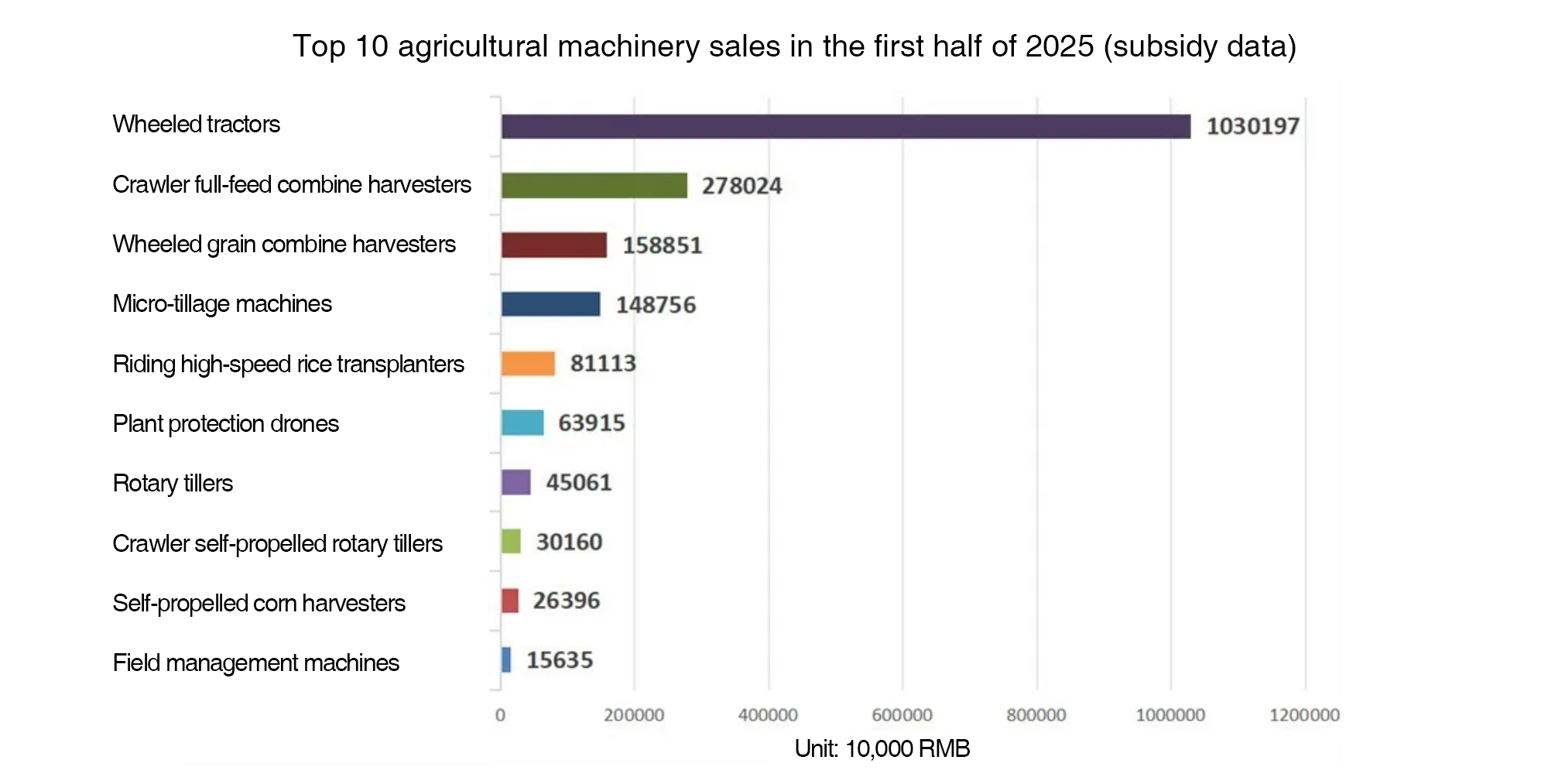

In terms of product categories, there are 14 product categories with sales exceeding 100 million yuan, among which the top ten are wheeled tractors with sales of 10.3 billion yuan; crawler full-feed combine harvesters with sales of 2.78 billion yuan; wheeled grain combine harvesters with sales of 1.63 billion yuan; micro-tillage machines with sales of 1.49 billion yuan; riding high-speed rice transplanters with sales of 810 million yuan; plant protection drones with sales of 640 million yuan; rotary tillers with sales of 450 million yuan; crawler self-propelled rotary tillers with sales of 300 million yuan; self-propelled corn harvesters with sales of 260 million yuan; and farmland management machines with sales of 160 million yuan.

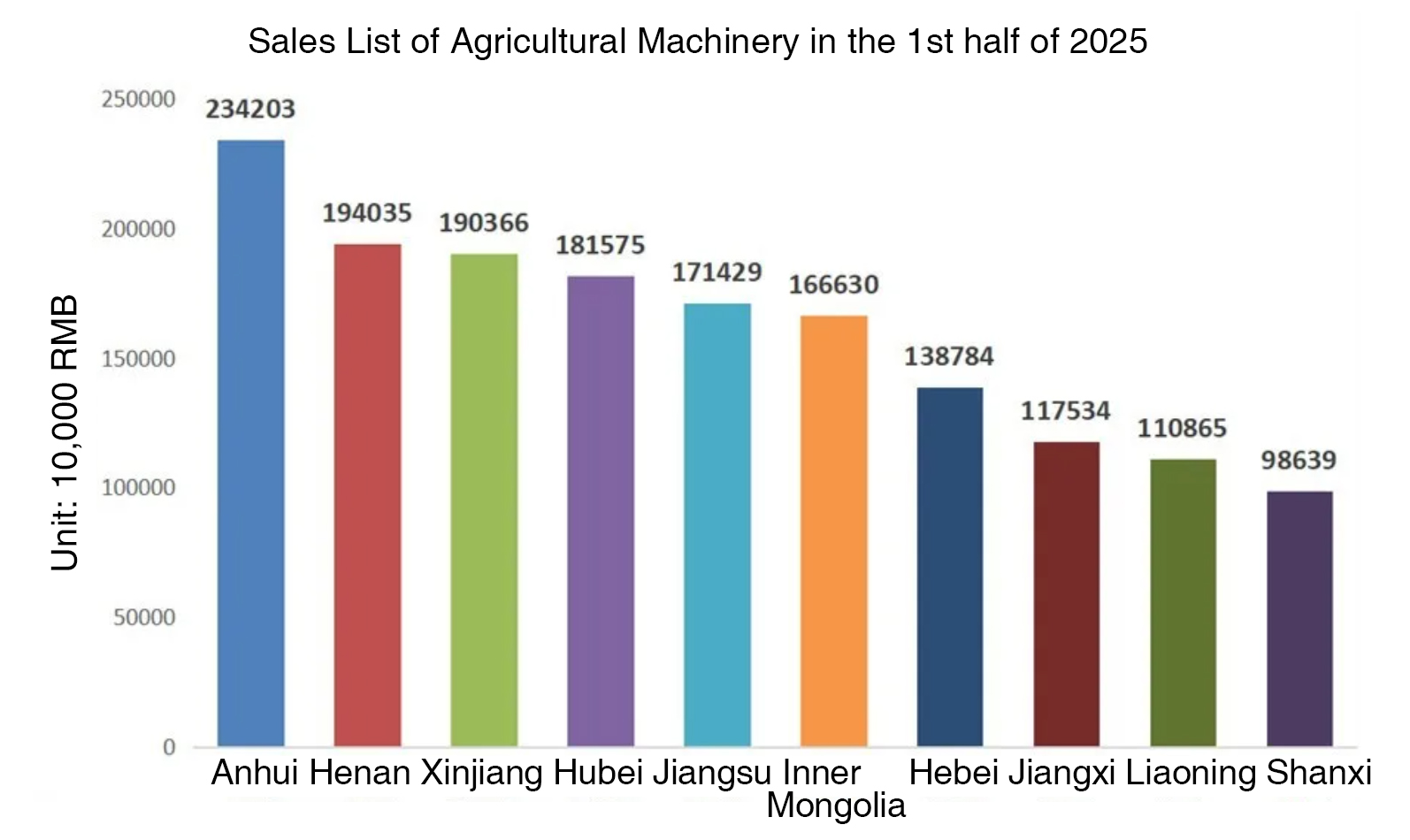

In terms of agricultural machinery sales in various provinces and regions, there are 9 provincial regions with sales exceeding 1 billion yuan, and 26 provincial regions with sales exceeding 100 million yuan. The top five provincial regions in terms of sales are: Anhui Province, 2.34 billion yuan; Henan Province, 1.94 billion yuan; Xinjiang (including the Corps), 1.90 billion yuan; Hubei Province, 1.82 billion yuan; Jiangsu Province, 1.71 billion yuan. Of course, due to the slow release of subsidy data in some provinces with large agricultural machinery sales, the sales of agricultural machinery in some provinces with large agricultural machinery sales ranked relatively low in the first half of the year.

In terms of sales of agricultural machinery products in the first half of 2025, there is only one single product with sales of over 1 billion yuan, and a total of 24 single products with sales of over 100 million yuan. Among them, the top five products are the 4LZ-8.0EP crawler self-propelled full-feed grain combine harvester of WODE, with sales of 1.05 billion yuan; the 4LZ-12M6 self-propelled grain combine harvester of LOVOL, with sales of 650 million yuan; the M2004-5RP tractor of LOVOL, with sales of 540 million yuan; the 4LZ-10R3 self-propelled grain combine harvester of LOVOL, with sales of 390 million yuan; and the CFJ2204 (G4) tractor of CHANGFA, with sales of 360 million yuan.